There comes a point in every adult’s life when they realize they’ve become the responsible one. They’re the fixer of all problems, emergency contact for family drama, human ATM in a headwrap. At first, it’s endearing, then it’s noble, and then one day you blink and realize you’re sponsoring everyone’s lives except your own.

And oh, if you dare to stop? Suddenly you’re the villain in a story you didn’t write. That’s the hard truth today’s Original Poster (OP) had to face after spending years being the go-to person for her family’s financial needs. However, when she decided to draw a line and prioritize herself, the emotional fallout was swift and brutally unfair.

More info: Reddit

RELATED:In many African and diasporic communities, success often comes with an unspoken invoice which has given way to the phenomenon now known as “Black Tax”

The author has been financially supporting her extended family since she started working as a teacher

Over time, the expectations grew from her family members for her to handle groceries and school fees to bills, car repairs, and even a cousin’s wedding

She decided to stop, choosing instead to save for her own future and set firm financial boundaries

Her decision was met with backlash from her family, who called her selfish and “whitewashed,” despite years of sacrifice

The OP is a teacher earning a modest income, who has long contributed to her extended family’s needs, including groceries, bills, school fees, and even sending her mother money monthly. Over time, however, her siblings began relying solely on her contributions, and her mother stopped saying no to their requests.

When the demands escalated to include car repairs and contributions for her cousin’s wedding, she realized it was time to reclaim her finances. She made the tough decision to set boundaries, telling her family she would no longer be the sole financial supporter.

Instead, she planned to save for therapy, travel, and a deposit on her own apartment, because she also had needs. Her mother then broke down, her aunt labeled her “whitewashed,” and her brother accused her of selfishness and forgetting her roots.

However after years of missed opportunities, drained savings, and living paycheck to paycheck, she had to prioritize her own well-being.

To better understand the complex financial and emotional weight behind the “Black tax,” We reached out to economist Angelina Ampadu, who explained that this phenomenon goes far beyond individual choice.

“From an economic standpoint, Black tax is pretty much an informal financial responsibility many Black professionals carry to support their extended families,” she explained, highlighting that this burden is deeply rooted in historical and systemic inequalities like generational poverty, limited access to education, and discriminatory hiring practices.

She went further by stating that due to this, when one family member achieves financial stability, they often become the primary supporter for others still facing economic hardships. This cycle, she pointed out, “not only strains individual finances but also hampers overall economic progress within Black communities.”

When asked how these pressures affect key financial goals, Ampadu didn’t mince words. “The financial demands of ‘Black tax’ often delay or prevent important milestones like retirement savings, homeownership, and personal development investments.”

She noted that consistently redirecting income toward family expenses like covering rent, education, or healthcare “leaves little room for long-term planning or asset building.” She added that, “saving for the future becomes secondary, property purchases get postponed, and opportunities for self-improvement or entrepreneurship are sacrificed.”

Finally, we asked Ampadu what advice she would give to those torn between family support and investing in their own future, and she offered compassionate yet practical counsel. “Remember, you’re not alone because this struggle is rooted in systemic challenges. While helping loved ones is important, continuous financial sacrifice can undermine your own stability.”

She emphasized that “building your wealth isn’t selfish; it’s necessary to support others sustainably over time.” Ampadu encouraged setting clear boundaries and communicating openly with family.

“Find ways to assist beyond money, such as sharing resources or improving financial literacy. Balancing care with self-investment is tough but it’s very important to break the cycle and create a stronger future for both yourself and your family.”

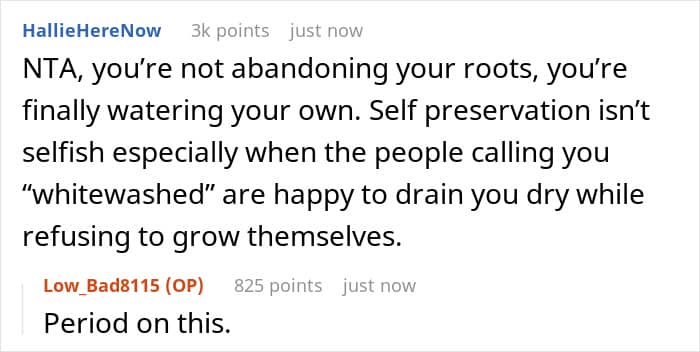

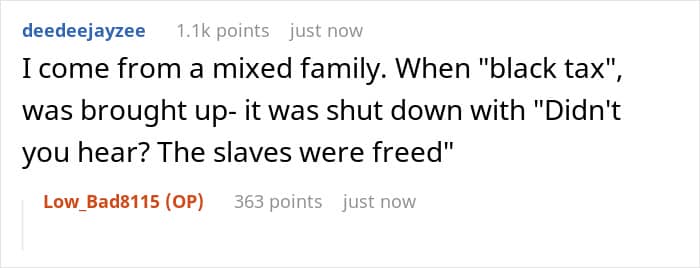

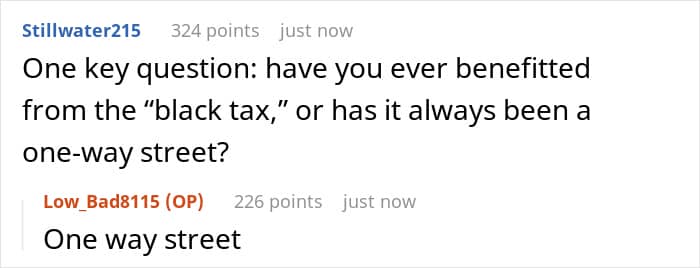

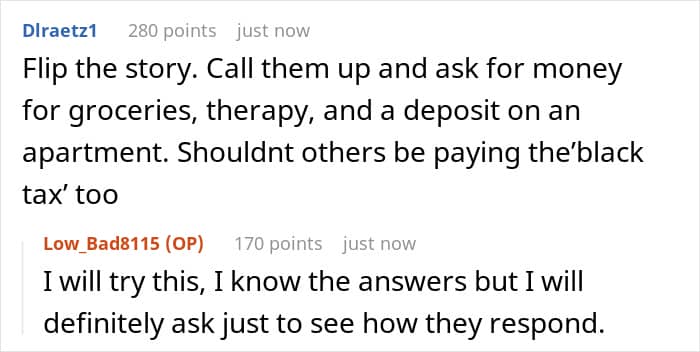

Netizens strongly supported the OP’s decision to set boundaries and prioritize her own financial wellbeing. They pointed out that the so-called “Black tax” is often used as a tool for guilt rather than genuine mutual support.

What do you think about this situation? Where do you think the line should be drawn between family support and personal financial boundaries? We would love to know your thoughts!

Netizens insisted that she is right for standing up to them and setting boundaries as her family members are simply entitled